What is the specific operation process of agency import and export?

According to the latest 2025 International Freight Forwarding Management Regulations, legitimate...Export agent35. Must simultaneously possess:

- International freight forwarding agency filing certificate issued by the Ministry of Commerce

- Certified by the General Administration of Customscustoms clearanceEnterprise Qualifications (AEO Certification Preferred)

- Cross-border receipt and payment qualification issued by the State Administration of Foreign Exchange

- Additional qualifications are required for special industries (e.g., medical devices require CFDA filing)

It is recommended to verify the certificate number on the official website of the "China International Trade Single Window" and to request proof of no violations in the past three years.

What specific contents does import and export agency service include?

A complete proxy service encompasses three core modules:

- Trade Compliance Module

- HS Code Classification (2025 Harmonized System)

- Proof of Origin

- Application for import and export licenses

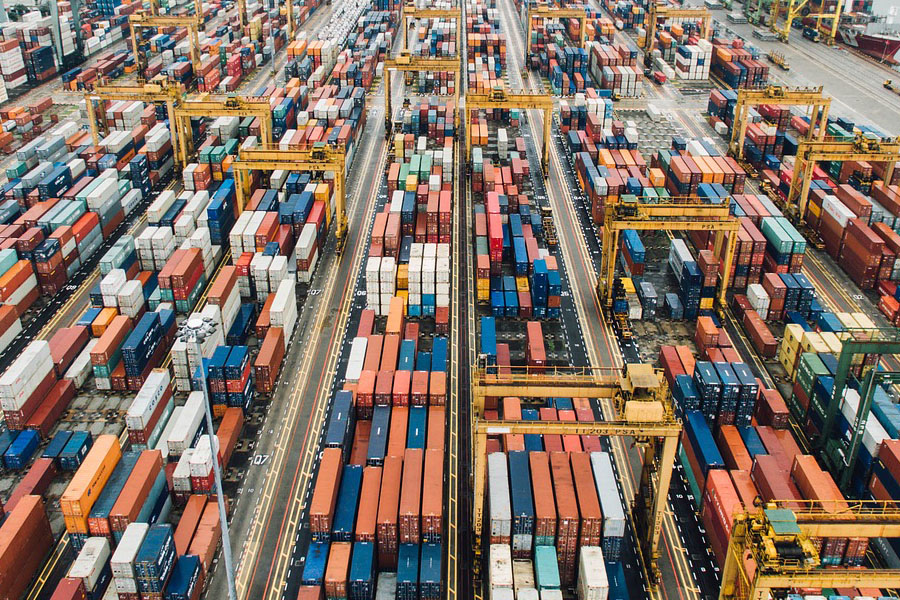

- Logistics Execution Module

- Multimodal transport solution design

- Special transportation of dangerous goods

- Cross-border insurance allocation

- Tax and Finance Processing Module

- Cross-border receipt and payment of foreign exchange

- Export tax refundAgently

- VAT tax declaration

How to verify the real capabilities of an agent?

The typical fee structure for 2025 includes:

- Basic service fee (0.8% - 1.5% of the cargo value)

- Emergency handling fee (inspection / document amendment / port detention)

- Cost of locking in the exchange rate (forward FX settlement is recommended)

- Special document fee (e.g., FDA inspection report)

It is recommended to explicitly include a "cost cap clause" in the contract, requiring the agent to bear any additional customs duties resulting from misclassification.

How to avoid the legal risks of choosing a proxy service?

Three key compliance points require special attention:

- Verify whether the review agent is on the OFAC sanctions list

- Confirm that the means of transport complies with the IMO’s new environmental regulations.

- Electronic data must comply with GDPR cross-border transfer requirements.

Typical case: A company had its entire shipment detained at the Port of Rotterdam because its forwarder used a sanctioned carrier; it is recommended to require the forwarder to update a compliance declaration monthly.

What should be noted for special commodity import and export?

Regarding key regulatory categories for 2025:

- Lithium battery: UN38.3 Test Report + Explosion-Proof Packaging

- 28. Food category: HACCP certification required

- Cosmetics: CPNP EU Notification Number

- Medical Devices: UDI Unique Device Identification

It is recommended to initiate the certification process six months in advance, especially for the newly introduced EU Extended Producer Responsibility (EPR) system.

Common Causes of Customs Clearance Delays and How to Address Them?

Customs statistics for 2025 show that the main causes of delay include:

- Disputes over commodity classification (38%)

- Certificate of Origin Defects (22%)

- Abnormal declared price (17%)

Professional advice: Request your agent to provide a pre-classification opinion letter, purchase customs-delay insurance for critical orders, and prepare two backup shipping plans in advance.

How can we effectively oversee the quality of agency services?

It is recommended to establish a three-tier monitoring system:

- Process visualization: GPS-enabled Logistics Tracking System with Proxy Integration

- Critical Node Confirmation: Real-time push notifications for sailing schedules, customs declarations, and arrivals

- Abnormal Response Mechanism:Provide a solution within 2 hours

The industry best practice for 2025 is to adopt blockchain-based evidence deposition technology, enabling tamper-proof traceability of customs declaration documents.

What special preparations are needed for emerging-market expansion?

Seizing the new opportunities arising from the full implementation of RCEP:

- Key Verification of FORM E Certificate of Origin by ASEAN Countries

- The African Union requires the processing of an ECTN cargo tracking note.

- South American countries should pay attention to the application of electronic bills of lading (such as the Bolero system)

It is recommended to request the agent to provide a customs-clearance capability assessment report for the destination country, with particular emphasis on localized interpretations of inspection and quarantine requirements.

Follow Customer Service WeChat

Follow Customer Service WeChat